The chip giant’s market share keeps getting bigger.

Taiwan Semiconductor Manufacturing Corporation (TSM 0.33%) might not be a household name, but it could be the world’s most important company.

TSMC, as the company is also known, makes more semiconductors than anyone else in the world. It’s the manufacturer that chip designers and tech giants like Apple, Nvidia, AMD, Broadcom, Qualcomm, and others all rely on.

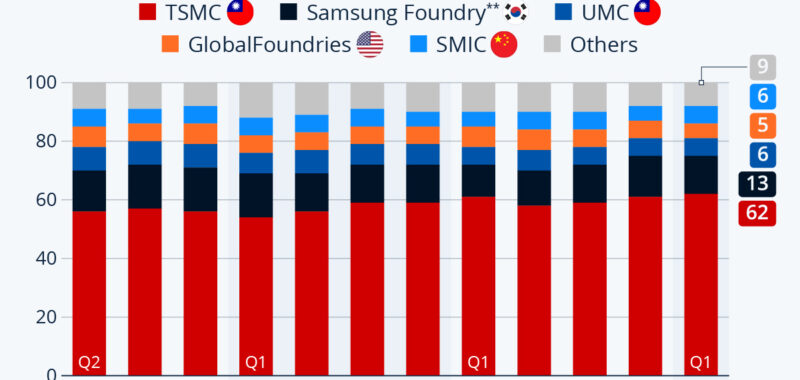

In other words, TSMC is a crucial linchpin in the global economy as the electronics the world depends on wouldn’t get made without the company. The chart below helps illustrate just how big a role it plays in the chip industry.

Image source: Statista.

TSMC’s wide economic moat

As you can see in the chart above, the company controls a solid majority of worldwide contract semiconductor manufacturing. Its market share has risen slowly but steadily in recent years, and it’s now above 60%.

Not only that, but TSMC has an even larger 90% market share of advanced chip manufacturing. That includes 3-nanometer chips that are quickly growing in popularity and becoming standard, as well as advanced chip packaging for larger components.

Companies like Apple and Nvidia rely on TSMC to make their chips because no other company can provide its capacity or level of technology.

That advantage is not going to go away easily as the company’s close relationships with industry giants also give it an advantage. Even Intel, which has its own foundry, relies on TSMC to manufacture some advanced chips, showing how entrenched its leadership is.

As the semiconductor sector rebounds from an earlier post-pandemic decline and benefits from growth in demand for artificial intelligence (AI) components, TSMC has seen revenue growth accelerate. Given its position in the foundry industry, it’s best positioned to capitalize on future growth in AI-related demand.

While other chipmakers and cloud infrastructure companies duke it out in the emerging AI space, TSMC seems like one of the easiest AI stocks to own today as it’s already the clear leader in the foundry business.

Jeremy Bowman has positions in Broadcom. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.