Amidst the slumpy market conditions, StakeLayer has surged by over 250% alongside Thala, Dream Machine Token, which surged by double digits.

The crypto market cap has dropped by over 1.5% in the last 24 hours. As per CoinMarketCap data, it currently stands at $2.17 trillion.

Bitcoin (BTC) is bleeding alongside Ethereum (ETH) in single digits. However, the Stakelayer token is up by over 250% during the same period.

Stakelayer market cap eyes $50 million with the pump

Data from CoinGecko reveals interesting price movement for the cross-chain staking and restaking platform’s token. The token has pumped from a 24 hour low of $0.00344 to a high of $0.001489.

The rally has however cooled down as the token is trading at $0.01299 at press time. StakeLayer also touched an all time high today and is down by over 27% from that high.

The token has also earned its spot as the largest gainer on CoinGecko in the last 24 hours. A look at their X account reveals that the team had announced a buyback and burn initiative, which could be one reason for its price surge.

Thala and Dream Machine Token surge double digits

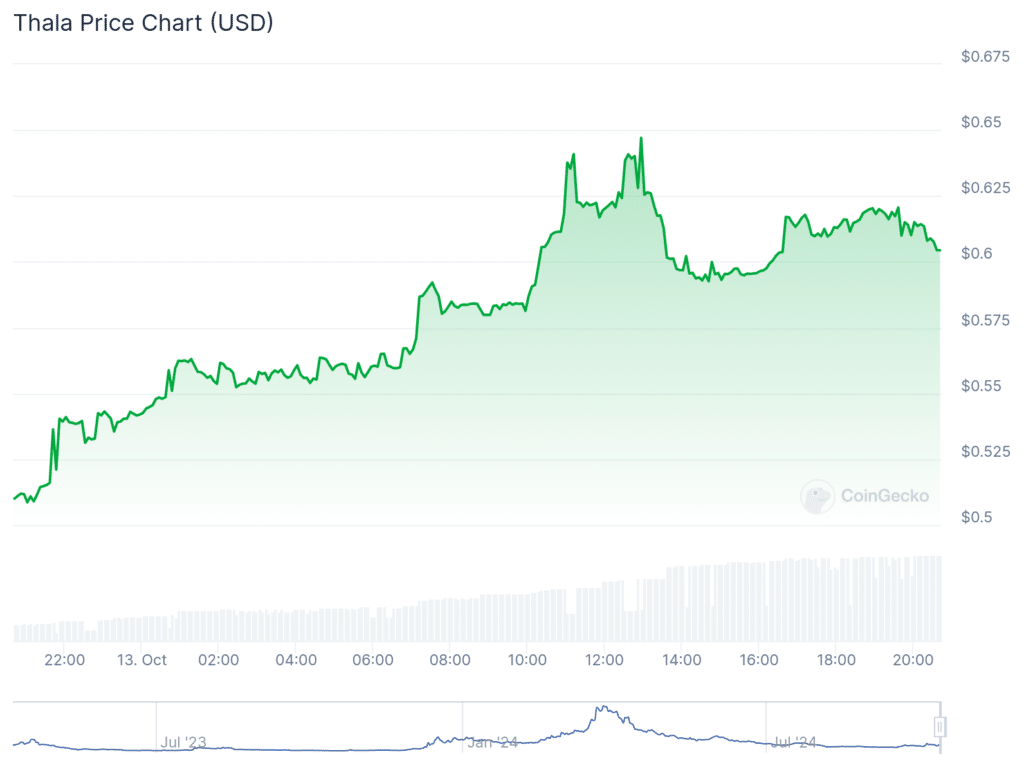

Interestingly, during the same timeframe, Thala (THL) and Dream Machine Token (DMT) surged by double digits. As per CoinGecko data, THL price is up by over 18.5%, while DMT has pumped by 20%.

Even though the exact reason for the surge in DMT’s price is unclear, THL’s price surge can be attributed to the price pump of Aptos (APT). Thala Labs is an ecosystem protocol that aids in borrowing, lending, trading, staking and validating APT.

The recent surge in APT’s price, which saw it touch as high as $10.27 from a weekly low of $7.87, is likely the primary catalyst for the surge in its price. THL is up by over 71% in the last 30 days.

The token has also shown a decent surge in the last week, with its price touching as high as $0.6354 from a low of $0.4228.