GE Aerospace (NYSE: GE) has had an excellent beginning as an independent company. The market has quickly responded by assigning it a premium rating, driven by strong operational performance and the promise of a long-term revenue stream from services related to its aircraft engines installed in airline fleets. But is the stock worth buying now? Here’s the lowdown.

GE Aerospace stock analysis

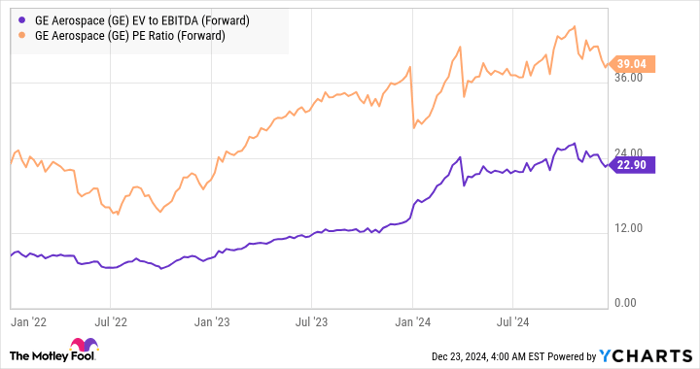

As you can see from a pair of standard valuation metrics below, the market is willing to pay a high multiple to get exposure to GE Aerospace’s long-term growth. As a rough assumption, a price-to-earnings (P/E) ratio of around 15 times earnings and an enterprise value (market cap plus net debt) to earnings before interest, taxation, depreciation, and amortization of around 11 times EBITDA can be seen as a decent value for a mature company.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Image source: Getty Images.

However, GE Aerospace’s forward valuations are significantly more than those figures.

Its dominant position in the commercial airplane engine industry is the reason. Its joint venture with Safran, CFM International, makes the LEAP engine the sole engine on the Boeing 737 MAX and one of two provided on the Airbus A320 neo family.

Moreover, the CFM56 is the sole option for the later models of the legacy 737 and is one of two main options for the legacy A320 family.

Moreover, GE’s dominance doesn’t stop in the narrowbody market. The GE90 engine runs the Boeing 777, and the GE9X will be the sole engine on the 777X. GE engines also power the Boeing 747, 787, and Airbus A330 widebodies.

The typical business model in the industry involves selling engines at a low loss only to generate multiple decades of service/aftermarket revenue as engines come in for “shop visits” over their lifetime, whereby they are overhauled and maintained. In a nutshell, the market is paying for future earnings based on its dominant position and the growth in flight departures (and ultimately engine use) rather than GE’s near-term earnings prospects.

GE EV to EBITDA (Forward) data by YCharts

The state of the industry in 2024

It’s been an unusual year for the industry. Flight departures have generally surpassed expectations, and GE Aerospace has had an excellent year with services in terms of revenue growth, margins, and orders. That led the company to raise its full-year 2024 earnings guidance through the year gradually.

That supported the stock price and gave investors hope that excellent service performance could continue into 2025.

| GE Aerospace |

At January |

At April |

At July |

At October |

|---|---|---|---|---|

|

Commercial Engines & Services (CES) segment profit |

$6 billion to $6.3 billion |

$6.1 billion to $6.4 billion |

$6.3 billion to $6.5 billion |

$6.6 billion to $6.8 billion |

|

Defense & Propulsion Technologies (DPT) segment profit |

$1 billion to $1.3 billion |

$1 billion to $1.3 billion |

$1 billion to $1.3 billion |

$1 billion to $1.3 billion |

|

Total GE Aerospace operating profit |

$6 billion to $6.5 billion |

$6.2 billion to $6.6 billion |

$6.5 billion to $6.8 billion |

$6.7 billion to $6.9 billion |

Data source: GE Aerospace presentations.

Moreover, as discussed elsewhere, GE’s management raised expectations for shop visit growth on its older CFM56 engine in the 2026 and 2027 time frames. The delays in production ramps at Airbus and Boeing mean older planes and engines like the CFM56 will be run more.

Is GE Aerospace a good value?

There’s no doubt that GE Aerospace continues to have excellent momentum. Still, a couple of concerns might cause a pause before buying the stock, particularly given its current valuation.

First, and going back to the table above, while management maintained its DPT segment guidance on the last earnings call in October, CFO Rahul Ghai told investors, “We expect DPT to be at the lower end of the current profit range of $1 billion to $1.3 billion.” The walking back of guidance is somewhat of a concern given the margin difficulties most defense contractors have faced in recent years with rising costs and problematic contracts.

Second, the aerospace industry still has a supply chain issue, and GE Aerospace has significantly lowered its expectations for LEAP output in 2024.

|

GE Aerospace Full Year Guidance 2024 |

At January |

At April |

At July |

At October |

|---|---|---|---|---|

|

LEAP deliveries growth (year over year) |

20%-25% |

10%-15% |

0%-5% |

Down 10% |

Data source: GE presentations.

While that’s not so much of a problem for near-term earnings (recall that engines tend to be sold at a loss), there’s no doubt GE wants to ramp LEAP engine output, not least as Airbus and Boeing, in particular, are aggressively looking to ramp production. Ramping LEAP output could turn into a cost issue in 2025.

Image source: Getty Images.

A stock to buy?

The above-mentioned concerns mean investors should pause for thought before buying GE Aerospace stock or wait until management gives formal guidance for 2025. The company and the stock have a big future, but it’s priced for perfection right now, and it makes sense to see what management will say in January first.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $362,841!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $49,054!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $498,381!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends GE Aerospace. The Motley Fool has a disclosure policy.