There are all sorts of myths attached to almost every aspect of personal finance, from investing to your credit score. Retirement is another common theme loaded with money myths. If you’re not careful, this kind of misinformation might cost you a comfortable retirement.

Find Out: How Long $1 Million in Retirement Will Last in Every State

Try This: 7 Reasons You Shouldn’t Retire Before Speaking to a Financial Advisor

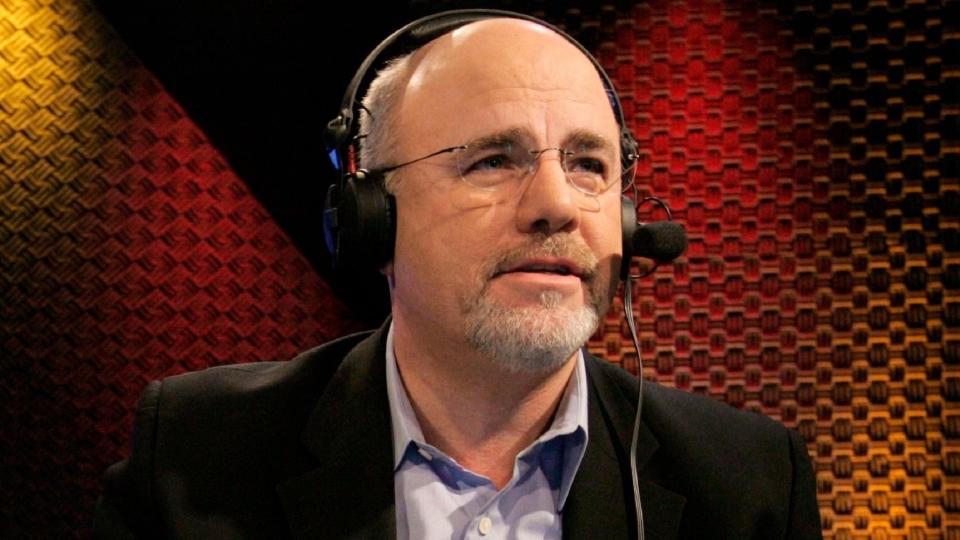

Money expert Dave Ramsey debunked some of the most popular retirement myths on his website Ramsey Solutions. It’s time to stop believing these six retirement myths.

Earning passive income doesn’t need to be difficult. You can start this week.

You’ll Live Off Social Security Alone

According to the post on Ramsey Solutions, retirees receive an average monthly income of $1,657 from Social Security. If retirees relied on this income alone, they would only receive $19,900 each year — and this amount cannot pay for a comfortable retirement.

While it is true retirees do receive Social Security benefits when they retire, these benefits are not designed to fund your entire retirement lifestyle. It’s up to you to start establishing a robust retirement portfolio today.

Read Next: I’m an Economist: Here’s My Prediction for Social Security if Trump Wins the 2024 Election

You’ll Have Enough Money To Retire If You Invest Up to Your 401(k) Match

Maxing out your workplace 401(k) is a great way to start investing for your retirement. However, you should not stop investing simply because you reached the match.

The post on Ramsey Solutions recommends investing 15% of your income into retirement. You can do this a few different ways, depending on if you have a traditional 401(k) or Roth 401(k).

Those with a traditional 401(k) are advised by Ramsey Solutions to contribute up to their employer’s match in their 401(k) and work with a professional to invest the rest into a Roth IRA.

If you have a Roth 401(k), it’s recommended you invest the full 15% into your workplace retirement account.

You’ll Work Through Retirement

This myth comes with a disclaimer from Ramsey Solutions. Retirees who do work when they’re retired will do it because they want to work. If they don’t want to and if they have financially set themselves up for a comfortable retirement in advance, they won’t have to do it.

Medicare Covers All of Your Medical Expenses

One of the biggest expenses in retirement is healthcare. While retirees are eligible for Medicare once they reach age 65, it is not designed to cover all of your healthcare expenses.

Retirees will need to pay for deductibles, copays and any long-term care expenses, according to the Ramsey Solutions post.

To help safeguard your retirement and combat any sudden healthcare costs, retirees are recommended by Ramsey Solutions to sign up for long-term care insurance once they reach age 60.

Retirees should also ramp up their retirement savings and invest money into a Health Savings Account (HSA) to help pay for any medical expenses.

It’s Too Late To Save for Retirement

Says who? There is always time to save for retirement and grow your retirement savings.

If you’re working with a shorter time horizon, Ramsey Solutions recommends investing 25% of your income each year until you reach age 67.

You Can Financially Guess Your Way to Retirement

It’s a pretty big myth to think you can financially plan your way into retirement on your own. Instead of attempting to DIY your retirement financial planning journey, Ramsey recommends working alongside an investment professional.

Why should you work with a pro? An investment professional can review your financial plan for retirement with you and determine if you’re on the right track. If you need to adjust to get back on track, they can share which changes to make based on their expertise — and not your guesstimates.

Moreover, working with a professional allows you to ask any questions you may have about retirement, get the answers you need and plan for the next chapter of your life with confidence.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey: 6 Biggest Retirement Myths You Shouldn’t Believe